Security

Security

- Everything

- Access Controls

- Access certification

- Alex Meyer D365FO Blog

- Audit

- Audit Trail

- AuditBoard

- Azure

- Change Management

- Change Tracking

- Cloud

- Compliant user provisioning

- Continuous monitoring

- Controls

- Critical Access

- Cross Application

- Customer Success

- Dynamics 365

- Dynamics AX

- Dynamics CRM

- Dynamics GP

- Dynamics NAV

- Dynamics SL

- Event

- FAQs

- Fastpath Customer Tips

- Fraud

- G2 Reports

- GRC

- Higher Education

- IGA

- IT Risk Management

- Identity Governance and Administration

- Identity Lifecycle Management

- Identity Management

- Internal Controls

- Licensing

- Microsoft

- Microsoft Dynamics

- Netsuite

- Oracle

- Oracle Cloud

- Oracle EBS

- Privacy

- RBAC

- Risk

- Risk analysis

- Role management

- SAP

- SOD

- Salesforce

- Sarbanes Oxley (SOX) Compliance

- Security

- Security and Compliance

- Separation of Duties

- UK Corporate Governance Reform

- UK Corporate Reform

- UK SOX

- User Conflicts

- User Management

- Workday

- cybersecurity

- identity, access and governance

- Audit Trail

- AuditBoard

- Azure

- Change Management

- Change Tracking

- Cloud

- Compliant user provisioning

- Continuous monitoring

- Controls

- Critical Access

- Cross Application

- Customer Success

- Dynamics 365

- Dynamics AX

- Dynamics CRM

- Dynamics GP

- Dynamics NAV

- Dynamics SL

- Event

- FAQs

- Fastpath Customer Tips

- Fraud

- G2 Reports

- GRC

- Higher Education

- IGA

- IT Risk Management

- Identity Governance and Administration

- Identity Lifecycle Management

- Identity Management

- Internal Controls

- Licensing

- Microsoft

- Microsoft Dynamics

- Netsuite

- Oracle

- Oracle Cloud

- Oracle EBS

- Privacy

- RBAC

- Risk

- Risk analysis

- Role management

- SAP

- SOD

- Salesforce

- Sarbanes Oxley (SOX) Compliance

- Security

- Security and Compliance

- Separation of Duties

- UK Corporate Governance Reform

- UK Corporate Reform

- UK SOX

- User Conflicts

- User Management

- Workday

- cybersecurity

- identity, access and governance

Everything

- Access Controls

- Access certification

- Alex Meyer D365FO Blog

- Audit

- Audit Trail

- AuditBoard

- Azure

- Change Management

- Change Tracking

- Cloud

- Compliant user provisioning

- Continuous monitoring

- Controls

- Critical Access

- Cross Application

- Customer Success

- Dynamics 365

- Dynamics AX

- Dynamics CRM

- Dynamics GP

- Dynamics NAV

- Dynamics SL

- Event

- FAQs

- Fastpath Customer Tips

- Fraud

- G2 Reports

- GRC

- Higher Education

- IGA

- IT Risk Management

- Identity Governance and Administration

- Identity Lifecycle Management

- Identity Management

- Internal Controls

- Licensing

- Microsoft

- Microsoft Dynamics

- Netsuite

- Oracle

- Oracle Cloud

- Oracle EBS

- Privacy

- RBAC

- Risk

- Risk analysis

- Role management

- SAP

- SOD

- Salesforce

- Sarbanes Oxley (SOX) Compliance

- Security

- Security and Compliance

- Separation of Duties

- UK Corporate Governance Reform

- UK Corporate Reform

- UK SOX

- User Conflicts

- User Management

- Workday

- cybersecurity

- identity, access and governance

Everything

GRC

GRC

Top 10 Reasons Why Organizations Choose Fastpath

By Janna Prowell

03/25/2024

4min read

Security

Security

Fastpath Joins Forces with Delinea to Deliver Enhanced Access Governance and Security

By Frances Fenemore

03/22/2024

4min read

Netsuite

Netsuite

Learn How Fastpath Can Secure Popular Business Applications

By Chelsea Bohnert

03/15/2024

5min read

Oracle

Oracle

Make the Switch from Oracle AACG to Fastpath Before the 2025 Deadline

By Fastpath

03/13/2024

2min read

Access certification

Access certification

Webinar Recap: The Evolution of User Access Reviews and Certification

By Jamie Cant

03/12/2024

5min read

Access certification

Access certification

Fastpath's Certification Module

By Chelsea Bohnert

03/08/2024

1min read

Security

Security

Future-Proofing Your Identity Governance and Administration (IGA) Strategy for Success

By Frances Fenemore

12/21/2023

2min read

Access certification

Access certification

Protect What Matters: Lock Down Your Online Retail Business During Peak Season

By Frank Vukovits

11/27/2023

2min read

Dynamics NAV

Dynamics NAV

2023 Community Summit – The Fastpath Review

By Jamie Cant

11/01/2023

3min read

Security

Security

Delinea Completes Acquisition of Fastpath

By Frances Fenemore

04/02/2024

3min read

GRC

GRC

Top 10 Reasons Why Organizations Choose Fastpath

By Janna Prowell

03/25/2024

4min read

Security

Security

Fastpath Joins Forces with Delinea to Deliver Enhanced Access Governance and Security

By Frances Fenemore

03/22/2024

4min read

Netsuite

Netsuite

Learn How Fastpath Can Secure Popular Business Applications

By Chelsea Bohnert

03/15/2024

5min read

Oracle

Oracle

Make the Switch from Oracle AACG to Fastpath Before the 2025 Deadline

By Fastpath

03/13/2024

2min read

Access certification

Access certification

Webinar Recap: The Evolution of User Access Reviews and Certification

By Jamie Cant

03/12/2024

5min read

Access certification

Access certification

Fastpath's Certification Module

By Chelsea Bohnert

03/08/2024

1min read

Security

Security

Future-Proofing Your Identity Governance and Administration (IGA) Strategy for Success

By Frances Fenemore

12/21/2023

2min read

Access certification

Access certification

Protect What Matters: Lock Down Your Online Retail Business During Peak Season

By Frank Vukovits

11/27/2023

2min read

Dynamics NAV

Dynamics NAV

2023 Community Summit – The Fastpath Review

By Jamie Cant

11/01/2023

3min read

Netsuite

Netsuite

Navigating NetSuite: Insights from SuiteWorld and the Importance of Having Strong Internal Controls

By Chelsea Bohnert

11/01/2023

2min read

Risk analysis

Risk analysis

Reality Check: Lessons of the MGM Resorts Security Breach

By Frances Fenemore

10/20/2023

2min read

Netsuite

Netsuite

SOX Compliance Certification | Fastpath and NetSuite

By Ryan Gase

10/16/2023

3min read

Access Controls

Access Controls

Strengthening Cybersecurity with Fastpath: Protect What Matters

By Frances Fenemore

10/05/2023

2min read

UK SOX

UK SOX

Making UK Corporate Governance Reform Work for Your Organization

By Jamie Cant

09/06/2023

5min read

UK SOX

UK SOX

UK Corporate Governance Reform: Four Key Changes Your Organization Needs to Make

By Jamie Cant

08/18/2023

3min read

Access Controls

Access Controls

The Access Control Paradigm - Unpacking ABAC, PBAC, and RBAC

By Chris Aramburu

08/08/2023

5min read

Elevating Compliance and Security: The Role of IGA Solutions and SOD Capabilities in the Mid-Market

By Frances Fenemore

08/08/2023

3min read

Access Controls

Access Controls

The Significance of Internal Controls in the UK Corporate Reform Act

By Frances Fenemore

07/10/2023

2min read

Identity GRC – Efficiently automate identity lifecycle management while adhering to security and regulatory policies.

By Charles Snellgrove

07/10/2023

2min read

Access Controls

Access Controls

The Crucial Role of Access Controls in Identity Governance and Administration Platforms

By Frances Fenemore

06/29/2023

4min read

UK SOX –What Should You Be Doing Now?

By Frances Fenemore

06/13/2023

2min read

Access Controls

Access Controls

Tailoring Access Risk Policies: Customizing Risk Rulesets for Your Organization's Unique Needs

By Chris Aramburu

06/13/2023

3min read

Access Controls

Access Controls

Best Practices for Managing Access Controls in Your ERP System

By Fastpath

05/19/2023

6min read

Sarbanes Oxley (SOX) Compliance

Sarbanes Oxley (SOX) Compliance

SOX Compliance Requirements in 2023: What Businesses Need to Know

By Fastpath

05/19/2023

9min read

Audit

Audit

The Empire’s Compliance Mess – More Problematic Than an Exposed Thermal Exhaust Port

By Fastpath

05/04/2023

2min read

G2 Reports

G2 Reports

G2 Risk Management Report Spring 2023 | Fastpath #1

By Fastpath

04/05/2023

2min read

Observations from IIA’s 2023 GAM Conference

By Fastpath

03/24/2023

4min read

Identity Management

Identity Management

Protect Your Organization with an Identity-Centric Approach

By Stuart Beattie

03/23/2023

9min read

Top 5 Tips for Onboarding New Employees in the Workplace

By Fastpath

03/13/2023

4min read

Identity Governance and Administration

Identity Governance and Administration

What is Identity Governance and Administration, and who needs it?

By Fastpath

03/13/2023

2min read

IGA

IGA

What can an IGA System do for you?

By Fastpath

03/13/2023

4min read

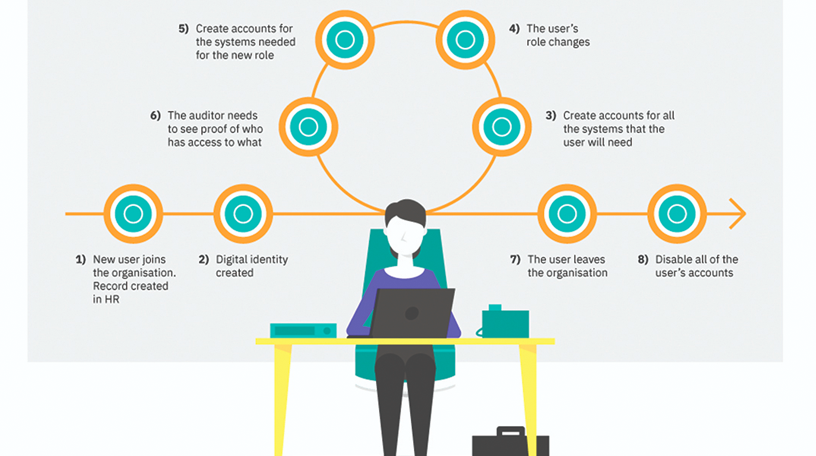

Identity Lifecycle Management

Identity Lifecycle Management

Identity Lifecycle Management | Fastpath

By Fastpath

03/10/2023

7min read

Identity Lifecycle Management

Identity Lifecycle Management

Automated Access Provisioning for your Organization’s Joiners

By Frank Vukovits

03/10/2023

4min read

Access Controls

Access Controls

Securing Student Access in Higher Education Institutions

By Fastpath

02/10/2023

5min read

Identity Management

Identity Management

Ease the IT Burden – Better User Account Management

By Fastpath

02/10/2023

2min read

Identity Management

Identity Management

Controlling User Admin Costs in Higher Ed without Compromising Security and Compliance

By Fastpath

02/10/2023

3min read

Access Controls

Access Controls

SOX Compliance - Salesforce | Fastpath Access Management

By Ryan Gase

02/09/2023

2min read

Access Controls

Access Controls

Workday Security | Fastpath Access Control

By Nick Sparks

02/09/2023

4min read

G2 Reports

G2 Reports

Fastpath Rated #1 IT Risk Management Solution in G2 Winter 2023 Report

By Fastpath

01/19/2023

2min read

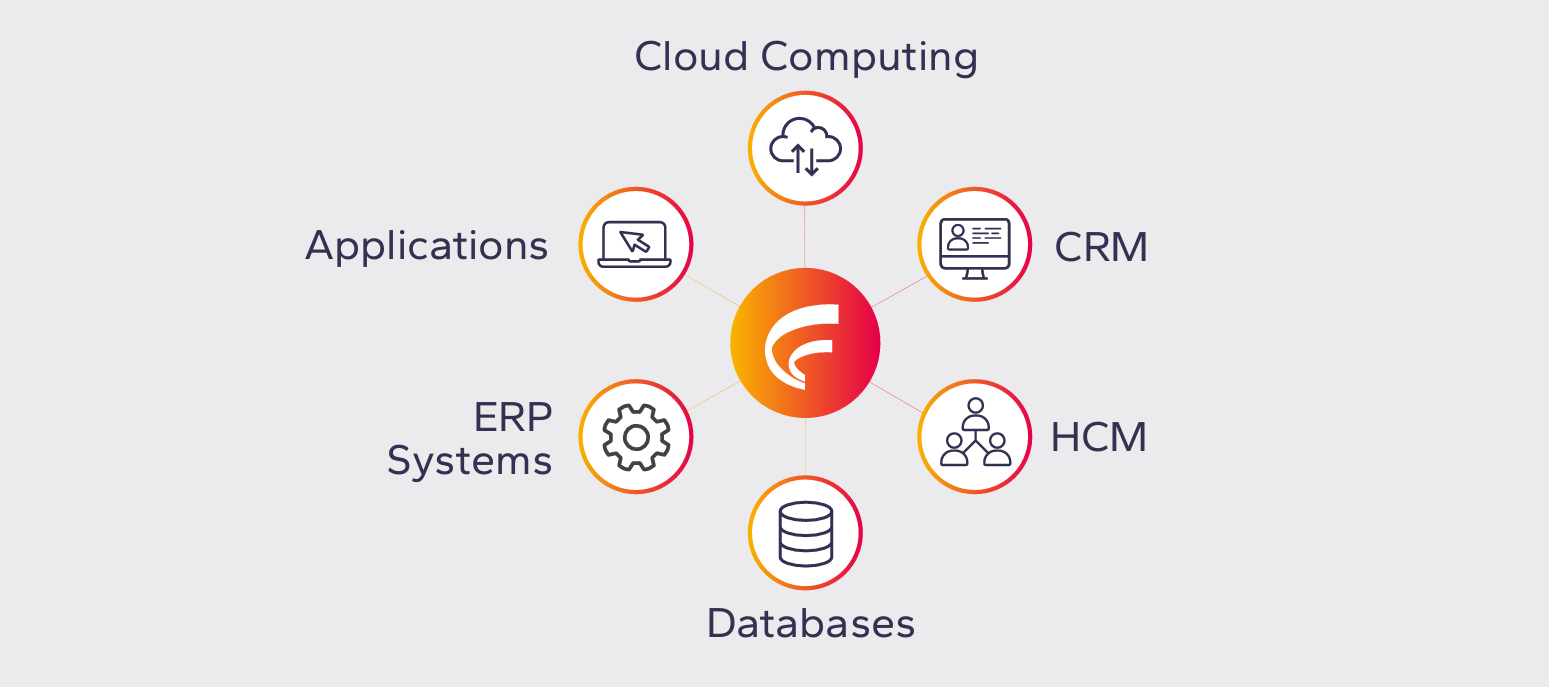

Risk analysis

Risk analysis

Where does Fastpath fit in your organization?

By Chris Aramburu

01/06/2023

2min read

Dynamics 365

Dynamics 365

Moving D365 for Finance & Operations Security Between Environments

By Alex Meyer

12/08/2022

2min read

Role management

Role management

Who Should Own The Auditing Tool In Your Company?

By Fastpath

12/08/2022

2min read

Access Controls

Access Controls

Fastpath Announces Rebrand as it Combines Access Controls with Identity Governance

By Fastpath

11/18/2022

2min read

Audit

Audit

Fastpath and AuditBoard: Powerful Audit and Compliance Capabilities

By Frank Vukovits

11/17/2022

1min read

Dynamics 365

Dynamics 365

Fastpath Joins Microsoft Intelligent Security Association

By Frank Vukovits

11/17/2022

1min read

Dynamics 365

Dynamics 365

Save on Licensing Costs in D365 Finance and Operations with Fastpath

By Alex Meyer

11/15/2022

8min read

Access Controls

Access Controls

Mandatory vs. Role-based Access Controls | Fastpath

By Fastpath

11/15/2022

5min read

Access Controls

Access Controls

What is Role Based Access Control (RBAC)?

By Fastpath

11/15/2022

3min read

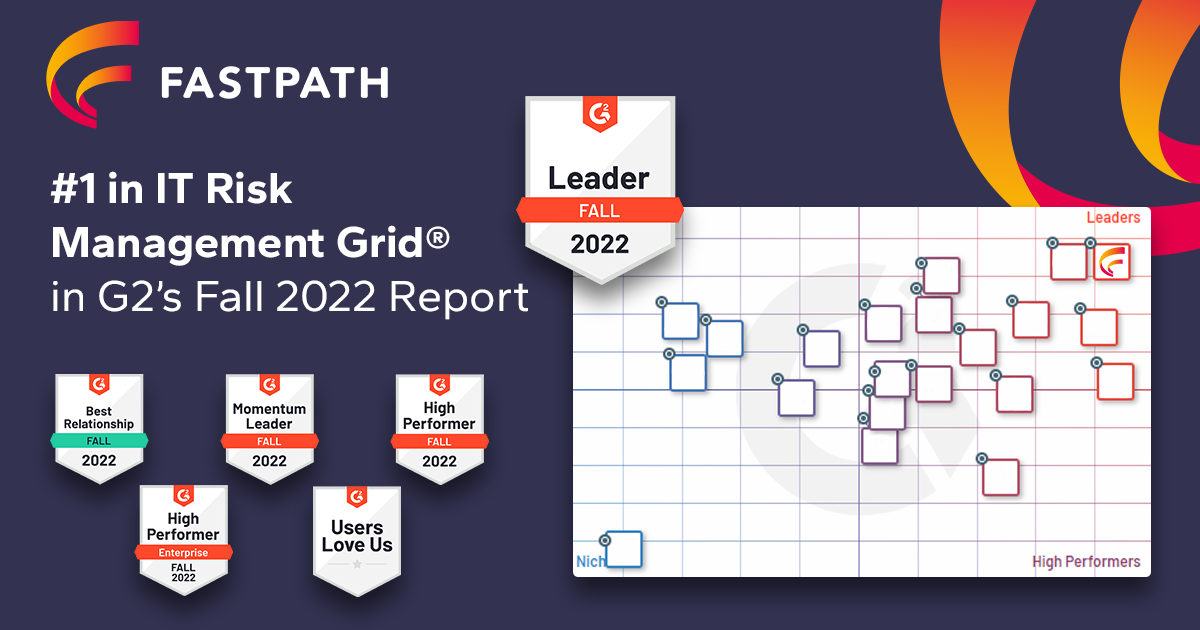

G2 Reports

G2 Reports

Fastpath Leads the Pack as #1 IT Risk Management Solution in G2 Fall 2022 Report

By Fastpath

11/15/2022

2min read

Why Your Company Needs a Digital Employee Directory

By Fastpath

11/14/2022

3min read

User Conflicts Detail Report in Fastpath

By Mark Polino

11/11/2022

2min read

Oracle EBS

Oracle EBS

Consider moving from Oracle AACG to Fastpath: Now is the time!

By Fastpath

11/10/2022

2min read

Access Controls

Access Controls

Top Tips for Offboarding Employees in the Workplace

By Fastpath

11/10/2022

5min read

Identity Management

Identity Management

Synchronized System Access Removal for Your Leavers

By Fastpath

11/10/2022

2min read

Access Controls

Access Controls

Using Zero-Trust And Least Privilege Access To Overcome Threats

By Frank Vukovits

11/09/2022

4min read

Audit

Audit

Is Your Organization Secure?

By Frank Vukovits

11/09/2022

6min read

Audit Trail

Audit Trail

Best Practices to Consider When Setting up Audit Trails

By Fastpath

11/08/2022

2min read

Sarbanes Oxley (SOX) Compliance

Sarbanes Oxley (SOX) Compliance

SAP Controls Series: Get SAP Under Control

By Aidan Parisian

11/04/2022

3min read

Sarbanes Oxley (SOX) Compliance

Sarbanes Oxley (SOX) Compliance

SAP Access Controls: An Audit Introduction

By Aidan Parisian

11/04/2022

4min read

Sarbanes Oxley (SOX) Compliance

Sarbanes Oxley (SOX) Compliance

Why care about SAP access controls?

By Aidan Parisian

11/04/2022

2min read

Netsuite

Netsuite

NetSuite Custom Record Security

By Fastpath

11/04/2022

3min read

Netsuite

Netsuite

Tracking Changes in Scripts and Workflows to Improve NetSuite Security

By Fastpath

11/01/2022

8min read